In this post, DOT TBA founder Christa Taylor considers the payback period for new TLDs based on recent auction prices and current registration volumes.

The October 22nd ICANN new top level domain name auction resulted in the resolution of several TLDs selling for substantial amounts of money:

- .Realty $5.6 million

- .Salon $5.1 million

- .Spot $2.2 million.

These results, along with the September 17th auction results of .buy at $4.6 million, .tech at $6.8 million and .vip at $3 million, reflect the substantial amount of funds and expected value of the new gTLDs. Justifying auction values that integrate into an existing business (such as Amazon winning .buy) may be easier to justify than a TLD solely in the business of selling domain names.

With over 200 new gTLDs now in the marketplace and the anniversary of the introduction of new gTLDs quickly approaching, preliminary insight into registration volumes, pricing and auction values is easily attained.

Currently, out of the 200 TLDs that have launched for over a month, the top quartile has about four times the registration volume of the second quartile. When extrapolated to one year at constant rates, the top tier can expected about 60,000 registrations. This drops by 75% in the second quartile, with 15,000 projected registrations for the first year. The third quartile can expect 8,700 registrations in the first year. (Note: the top quartile has been adjusted to eliminate TLDs with known free registrations, as the payback and renewal rate will not reflect the average TLD.)

If we use these registrations volumes and conduct a very simple* (see below for an explanation) auction value payback calculation based on three different price tiers, the results for the top tier are for the most part very reasonable. For example, a TLD with an auction value of $4 million which sells registrations at a net of $20 to the registry will recover the auction amount in approximately two years and six months; At $50 it will take about 15 months.

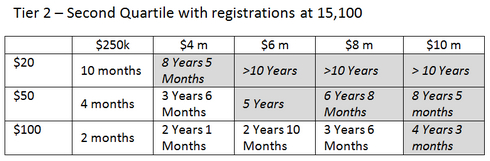

However, the picture drastically changes in the second quartile, referred to as Tier 2, where the volume of registrations drops by 75%.

In this second tier, a TLD that sells for $4 million and a wholesale registration price of $20 will take almost 8.5 years to breakeven. However, if the price is increased to $50, it will take just over 3.5 years and at $100 just over 2 years. If an acceptable payback period is three years, then any auction value over $4 million will need to net over $50 per registration to the registry. (Note: this is the wholesale price, not including registrar markup). This is a significant price increase from what registries are currently charging in the market and does not take into account the potential impact on volume due to the higher price to the registrant.

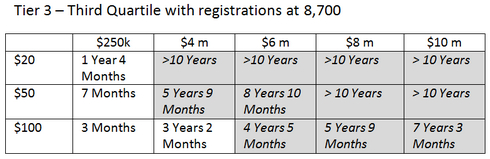

The payback period grows significantly worse as we move down into the third percentile (tier 3):

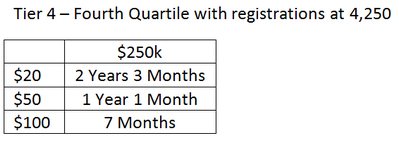

The final quartile has almost half the registrations as tier 3. Any auction value of $4 million or more will take over ten years to pay back at even at $20. A minimal application fee of $250k will take over two years to recover.

These are basic, ‘back of the napkin’ calculations* but are nevertheless troubling.

This is further supported with ICANN’s “Report of Public Comments” item 3, which discusses revenue regarding the registration of 33 million domain names for its FY 2015 budget. (This number has since been lowered to 15 million).

Ignoring that fact that the breakdown doesn’t equal 100%, the reply notes that the number of expected registrations for registries above 50,000 is 60,000 registrations. This is currently in line with the top quartile. However, ICANN’s response goes further stating 6.7 million registrations are expected from the registries exceeding 50,000 registrations. So ICANN budgeted 134 delegated registries would have transactions exceeding 50k registrations. Based on the current number of delegated TLDs only 26 meet this criteria, which is 20% of ICANN’s budget. The second quartile reflects an average of 15,100 registrations which is also very close to ICANN’s 15,000 registrations for other registries. This leaves the remaining third and fourth quartile (50% of all registries) not meeting the expected 15,000 yearly registrations.

With registration volumes far below expectations, the industry needs to take action. A global awareness campaign needs to be initiated targeting individuals, business and organizations to not only understand but to purchase new gTLDs. Additionally, a marketing plan to allocate ICANN auction funds needs to be in place to increase registrations. This is to everyone’s benefit, from the back-end providers to ICANN to the registries. If the average time from auction to General Availability is, for example, four months, then delay the use of the funds for the given amount of time to ensure the auction participants have the opportunity to receive a portion of the benefit from the use of the funds.

So as we all recover from the Los Angeles ICANN meeting, perhaps now is the time to begin the community consultation on the productive, timely use of these funds to benefit all new gTLD’s in a timely and efficient manner. With over $27 million already accrued and over 35 TLDs scheduled for auction before year end, there will be a significant amount of funds that can be used to grow the industry and registration volumes.

* Calculation notes: These are simplistic calculations with no expenses being considered including marketing, operational, backend provider, ICANN, etc. Volume of new registrations projections are based on 100% in year 1, 75% of year 1 in year 2, 60% in year 3, 45% in year 4 and 30% thereafter. Renewals at 70% all with a one year registration period. Does not include revenue from sunrise, landrush, and premium domains.

Christa,

Excellent analysis! This should be required reading for all registries.

You also make a key point about the ICANN budget.

ICANN should be sharpening their pencils now to ensure up-coming expenses don’t out-pace actual revenue. Acting surprised is not an option.

Large buyers of gTLDs at auctions do not rely on the role of a pure Registry to generate ROI. They are investing long term, having secured investor backing and/or planning an IPO. Also, there is plenty of outreach to technology sector companies for joint ventures. Anyone calculating the survival of a Registry based on their pure registrations is misguided about their business model. For less financially sound “community” Registries the game might be tougher but they too have options to generate revenue from add-on services.

“Large buyers of gTLDs at auctions do not rely on the role of a pure Registry to generate ROI.”

I know of a handful of smaller and one-off registries that have business models other than just registration revenue, but I haven’t heard of any “large buyers of gTLDs” with plans to sell additional services. M+M might be an exception with their vertical integration.

Andrew, two distinct types in my comment. 😉

Christa, Clever post,. Sucinctly put. This is just the tip of the iceberg. Your calculation notes / assumptions are very conservative. it is absolutely imperative ICANN immediately puts all auction monies into a global marketing effort. Registrations to date are very disappointing , even more so when you take out “sales” to vertically integrated registrars. . 80% of these new TLDs , with or without the extra auction funding costs are simply not sustainable by end of Year 2 .COI calcs here we come. ICANN we have a problem -. which will only get worse with more failed launches. Please act now.

Dear Christa,

this is a good insight for people who haven’t yet crunched the numbers. And I agree: There might be some applicants who do not care about profitability.

Albeit: I can’t really imagine ANY applicant – especially ANY auction participant – who wouldn’t research his business case in depth. And “in depth” doesn’t mean just to multiply price to the registrar by potential registrations. These calculations are usually of a much more elaborate nature.

One point you did not factored in at all: Premium sales. Land-rush auctions.

However – also not factored in: In many of the new gTLD’s the overwhelming majority of registrations is of either defensive or speculative nature. In some new namespaces 80% or 90% of the names are “parked”. Needless to say that the “traffic” monetization in almost all cases leads to zero revenues. There is no “traffic” on “parked” pages on most new gTLD’s. Were should it come from after all? That’s relevant because soon the “speculators” will find out the hard way that their “investment” is worth nothing – no one wants to pay money to “buy” their domains. And the registration costs can’t be “earned” by parking.

The real litmus test will be the renewal rate in the 2nd and 3rd year. And I expect we will see surprises. The TLD’s with “real” value to the registrants and Internet users will do good. Others will suck.

But you are right: In some cases I really wonder how the applicants want to earn back their investment.

Alexander

Perhaps we now know what ICANN should be spending the proceeds of the TLD auctions on! They should be using it on advertising to increase awarenes amongst the general public and small companies

The history here is that ICANN was generally trying to remain “neutral” about new TLDs. They certainly shouldn’t promote one TLD over another. They could, of course, market that there’s now choice.