Patting yourself on the back can have adverse effects.

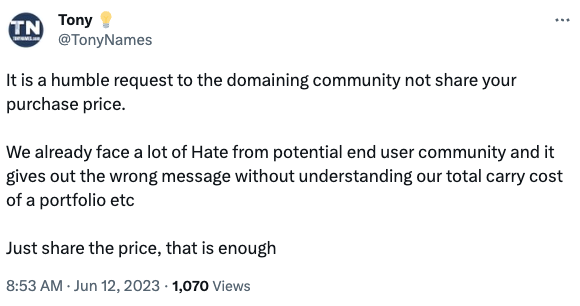

Earlier today, domain investor @tonynames posted a request to domainers on Twitter:

Tony is referring to a common practice of domain investors: mentioning how much they bought a domain for and how much they sold it for.

The problem with this is twofold.

First, it gives ammunition to people who hate “squatters”. You charged me $4,000 for something you bought for $40?! That’s crazy!

Second, it ignores the reality of domain investing for most domainers. The unit economics are spectacular, but the overall economics are tough because you only sell a small portion of your portfolio each year.

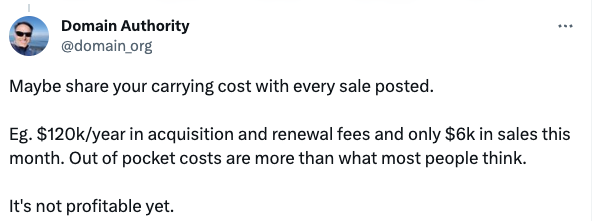

Consider this response from @domain_org:

When someone tells me they sold $100,000 of domains last year, I often ask them what their carrying costs are. On top of that, how much did they spend on new acquisitions this year to keep the sales flowing? In other words, what’s their cash flow?

Anyone can build a portfolio that generates a lot of sales, but are they actually adding money to their bank account?

Some see sharing acquisition costs publicly as beneficial, but I don’t.

Acquisition and holding costs are up across the board: hand regs, BINs, expired auctions and renewals, etc.

GD now has $22 renewals on dot Com; how long before it reaches $30? Hence a 1K portfolio was $10K renewals in 2015, $15K (2020) and $22K (2023).

Not small leaps in holding costs.

I doubt most domainers are adding real profits to their bank accounts.

Most are just breaking even YoY at best, if making any profits at all.

The illiquid nature of domaining is inescapable.

STR rates and average sell prices ($2,300) are ignored because too many see the DN Journal top 10.

Crypto & NFT peak of 2020 influenced many domainers habit of domain showcasing (unverified sales/blacked out) for attention.

Just to call out one thing here…if you have 1,000 domains at GoDaddy, you’re definitely not paying $22k each. You’re in the Domain Discount Club paying less than $10. BUT, that prices has increased about 7% a year along with Verisign’s increase. And your overall point is taken.

Even Domain Discount Club is an annual fee I’m not interested in paying.

Paying GD $250 annually, so they can charge you more than it costs to transfer the domain to another registrar?

I get it, those w/ 5K+ portfolios are mostly a captured consumer, but as long as I own less than 1K domains; transferring out is cheaper.

GD could eliminate a lot of their competition if their renewals were ALWAYS $9.99, but then they have to pay for those mergers & acquisitions, eh?

“First, it gives ammunition to people who hate “squatters”. You charged me $4,000 for something you bought for $40?! That’s crazy!”

Those people fail to see the bigger picture in my opinion. Real example: “You paid $10 for a domain, charged me $3,500 but… the website I built on that domain has earned more than $75,000+. So $3,500 is a bargain when considering the potential use of a domain name. The bigger picture matters.