Move makes it easier for U.S. investors to invest in the company. U.S. investors interested in investing in domain name company Team Internet Group now have an easier option. The company trades on the London Stock Exchange's market for small and ... Continue Reading1 Comment

.IO is not raising prices

· Domain RegistrarsDespite a recent announcement by one domain registrar, .io domains prices aren't jumping. Earlier today, domain name registrar Hexonet sent a notice to customers about a .io price increase. The message stated: We have recently been informed about ... Continue ReadingLeave a Comment

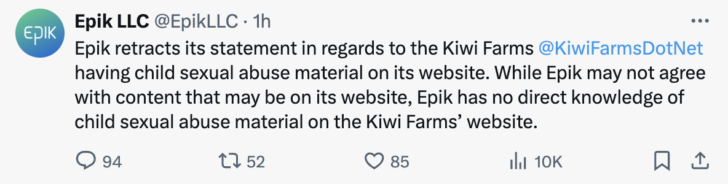

Epik retracts statement about Kiwi Farms

· Domain RegistrarsDomain registrar says it has no direct knowledge of underage porn on the website. Domain name registrar Epik has retracted a statement it made after booting the website Kiwi Farms from its service in December. At the time, Epik stated that it ... Continue Reading1 Comment

Squarespace’s new regs drop 10% MoM, but might be stabilizing

· Domain RegistrarsSquarespace registered fewer .com domains again, but the month-over-month drop wasn't as extreme. I've been tracking Squarespace's new .com domain registrations since it took over Google Domains in early September. Here's the data : August ... Continue ReadingLeave a Comment

Squarespace revenue tops $1 billion in 2023

· Domain RegistrarsCompany reports robust growth in 2023 and says its Google Domains acquisition is performing well. Squarespace (NYSE: SQSP) reported Q4 and full-year 2023 earnings today. For Q4, the company grossed $270.7 million, up 18% from $228.8 million in ... Continue ReadingLeave a Comment

Domain business remains strong at Tucows

· Domain RegistrarsSlow and steady... Tucows (NASDAQ: TCX) reported Q4 2023 earnings after the market closed yesterday. The company posted total Q4 revenue of $87.0 million, up 10% year over year. Tucows Domains accounted for $61.8 million of that. This ... Continue ReadingLeave a Comment

GoDaddy reports strong Aftermarket growth in Q4

· Domain RegistrarsNameFind Auction and one-off sale help aftermarket revenue jump 14%. GoDaddy (NYSE: GDDY) reported Q4 2023 and full-year 2023 earnings after the market closed today. For Q4 2023, revenue came in at $1.100 billion, up 6% from the same quarter a ... Continue ReadingLeave a Comment

.Com rankings: Squarespace continues to fall, Gname surges

· Domain RegistrarsSquarespace registers fewer new .com domains, and Gname moves up the overall leaderboard. Last month, I wrote about how new registrations at Google Domains plummeted after Squarespace (NYSE: SQSP) took over. I mentioned that a primary reason was ... Continue ReadingLeave a Comment

Registered Agents Inc. indeed acquired Epik

· Domain RegistrarsCorporate formation business bought domain name registrar Epik. When Epik was acquired in June of 2023, allegations in a lawsuit said that Registered Agents, Inc. was the buyer through a new entity called Epik LLC. And the asset purchase paperwork ... Continue Reading1 Comment

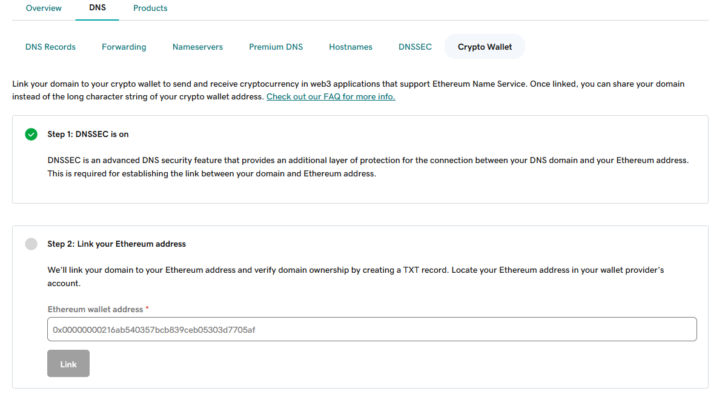

GoDaddy makes connecting domains to crypto wallets with ENS easier

· Domain RegistrarsWorld's largest domain registrar adds two-step wizard for connecting domains to Ethereum wallets. Last week, Ethereum Name Service (ENS) announced a new, "gasless" way to connect real domain names with wallet addresses. Today, GoDaddy (NYSE: ... Continue Reading4 Comments