.Com continues to grow, just at a slower pace.

There are many ways to measure .com.

There’s the zone file, the monthly reports Verisign sends to ICANN, and Verisign’s quarterly numbers revealed to investors.

Each of these numbers is measured differently. For example, some include domains in pending delete, while others don’t. The quarterly number combines .com with .net.

The key to measuring .com over time is to use consistent numbers. To compare apples to apples.

In this post I’ll provide data about .com’s growth over the past five years using data from the monthly reports Verisign submits to ICANN.

(These reports are made public three months after the the end of the month, which means there’s no data from Q2 2014. This is the period in which Verisign reported a sharp drop in “net adds” of domain names using the third measure listed above. Although new registrations were healthy, the renewal rate dropped.)

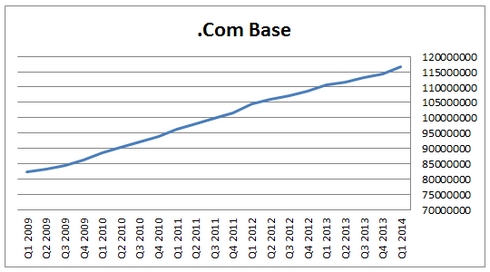

The number of registered .com domain names in the monthly reports has increased by at least 1 million each quarter during this period, with a median of about 1.7 million net adds.

You’ll note that the first quarter of each year is generally strongest. There’s seasonality in the domain name registration business, both natural and artificial (due to marketing programs).

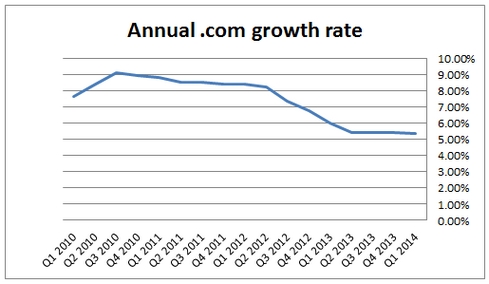

Because of this seasonality, comparing quarter-over-quarter growth isn’t the best way to look at growth in .com. A year-over-year comparison is better:

The increase in the .com base is growing at a slower rate than before.

This will happen, of course, regardless of renewal rates and new registrations. As the existing base gets bigger, the percentage gain by the same gross gain is smaller.

The annual net adds have certainly been slipping, though. Over the past four quarters they’ve been in the 5.0-6.0 million range; in prior years they’ve been between 6.0-8.0 million.

Andrew, it appears Warren Buffett read your analysis. He just announced he bought shares in VeriSign.

One of the arguments of the new TLDs is that there are millions and millions of users which are now or will be launching new businesses in the coming years. They will need a domain and will not be able to find a .COM. Is the domain aftermarket booming? There are sales but 2014 sales are nothing extraordinary compared to prior years. If .COM registrations are slowing then why do we need the new TLDs again?

“If .COM registrations are slowing then why do we need the new TLDs again?”

What is happening is that ccTLDs have been gaining ground, so the relative market share of .com has decreased in favor of ccTLDs.

Correction. It was announced this afternoon that Buffett increased his ownership of VeriSign to 10.5% from 9%

That is definitely a vote of confidence.

I did not realize Berkshire Hathaway owned that much of VeriSign.

Maybe Mr. Buffett can see why the contracts for the gTLD’s verisign applied for are still not signed.

My word! That upward trajectory in the .COM base is a straight line!

It’s still worth pointing out — since observers often talk about lower annual growth in registrations as a “deceleration” — that domain registrations are not one-time purchases; they’re ongoing subscriptions. Subscription income is means ongoing revenue at some rate.

So as long as the second graph, “Annual Growth Rate”, is above 0.00%, then .COM revenue is not only growing, it’s accelerating.

If they’re growing at such a slower place then why are more and more domain name programs coming out with great features? Have you heard about (removed). They’ve been around for 15 years, so I’m confused.

Jozef, namestrap has only been around 9 months as a site to promote domains for sale.

I would guess .com has been around over 30 yrs. And, VeriSign has had the contract for 15? yrs after the spinoff from Netsol. (going from memory which might be slightly off). 🙂