Like many great one word domains, Candy.com could have been used by just about any company.

For years, Candy.com was used as an exact-match, category-defining domain name.

Domain investor Rick Schwartz sold the domain name for $3 million plus royalties in 2009. The buyer set up a site that sold candy online.

Over time, that company found its bread and butter was creating a logistics and fulfillment system for refrigerated products. So it got out of the candy-selling business and transitioned to offering its logistics services to other companies. Andrew Miller recounted the story in DNW Podcast #320, at about the 26-minute mark.

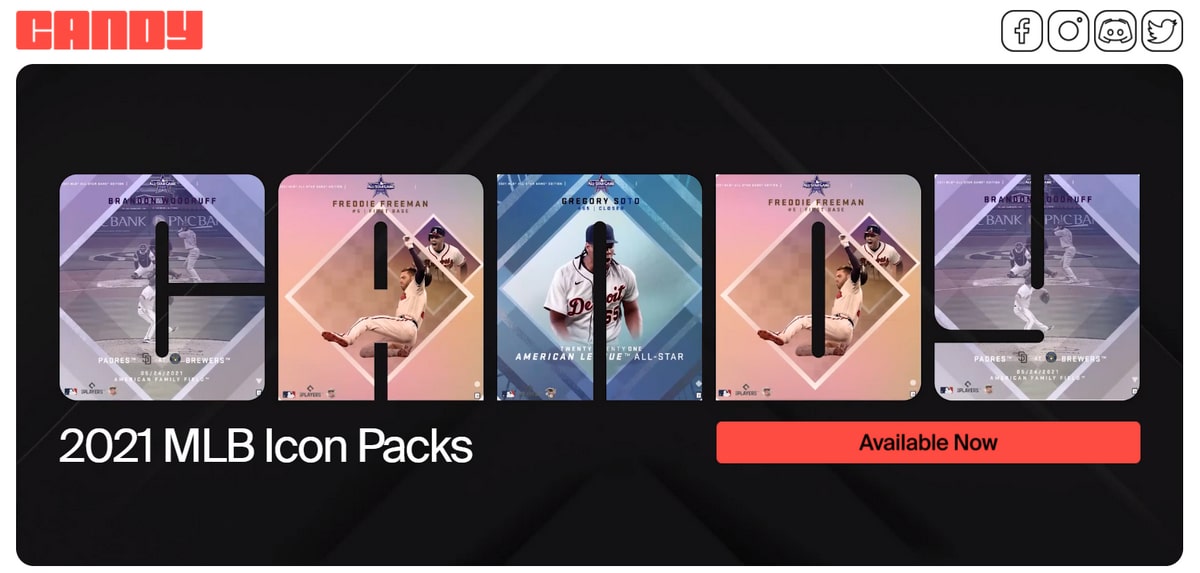

A new company stepped up to acquire the domain earlier this year and it has nothing to do with selling candy. Candy.com is now an NFT business focused on selling sports-themed non-fungible tokens.

Candy.com has been in the press a lot lately. In June, Major League Baseball announced a long-term deal with the business to sell MLB-themed NFTs. MLB has been sending promotions for NFTs on Candy.com to its massive email database, including for an NFT pack drop later today.

Over the past few years, domains that were once exact-match, category-defining domains that would have been used to sell the product they describe have become brandable domains. Candy is one example of that. The key is connotation. When you think of candy, you think sweet. It brings up good memories. A thousand different companies could have branded as Candy.com.

Companies still buy domains for their exact match use: Christmas.com, RX.com, Nursing.com, Floor.com. But Carrot.com doesn’t sell carrots and Blade.com doesn’t sell razors. Today’s top sales are words turned into brands, like Hippo.com (insurance), Angel.com (entertainment), and Badger .com (crypto).

Interesting case, one still has to wonder, if you put enough money and advertising, especially partnering with MLB behind any dot com, does the name even matter if it isn’t category matching?

I would think it does not and last time I checked (avid collector of cards btw) the term candy/sweet has absolutely nothing to do with the business of sports cards.

This all can lead to another debate, if you would have me believe the best use case or a great use case for a targeted domain is not for that audience at all… well now what is a targeted premium dot com worth now?

Think about it, it was actually worth it to NOT use Candy to sell candy at the end of the day based on their experience. If so it wouldn’t be selling NFT’s.

Basically you have to choose a side, cant play both.

All exact match domains are not created equally. What is the average sales price of candy? Very little.

What kind of margins? Small. Have to turnover lot of sales to squeeze out meaningful profits.

I think you will find domains that correspond to expensive products, ie houses.com, cars.com, etc are almost always used for those exact products.

It’s the low value, low margin product domains that could more suitable for brands instead of selling the exact product online. Like candy and carrots.

That’s the power of the .com TLD more than anything else, you are on the same block as Fortune 500 companies Apple, Google, etc

I agree, not all created equal, obvious use cases for homes, cars, insurance etc are indeed obvious. I should have been clearer, yes.

But Candy.com was not a cheap category name, if anything it was basically the best hoped for, no? We all are aware in North America that a handful of families (some now public) make up the vast majority of sales in that industry. The history channel has taught us how they started (Foods that made America?)

What the purchaser in this case did was try to buy their way into a segment (candy) by buying a name for millions of dollars based on a pitch. The real value in Candy.com it turned out was only perceived value. Finding second life off brand absolute kills the initial pitch buy the seller and was a saving grace to the purchaser.

If selling Candy on Candy.com was more profitable it would be doing just that.

Bottom line, as you stated correctly, “All exact match domains are not created equally.”

jmo

Candy is perishable and chocolate will melt, very bad product to sell online if you have to keep cool in transit.

Seems like the new company green rabbitt or whatever it’s called now is focusing on that niche they found, transit of product that needs to keep cool.

They used Candy.com to understand ecommerce and scale, and then focused on a larger niche ie transport of perishable goods, not just candy.

So there was clearly value in operating Candy.com before reselling it imo, led to bigger opportunity with more white space and higher margins.

Perhaps I’m wrong didn’t study the transition of the company but that’s what it appears on surface.

I am sure there is value to lessons learned, yes.

Just glad it worked out for them at the end of the day, I assume.

Seems like it worked out for them but you never know.

eCommerce so damn competitive nowadays. You really have to focus on one niche where you have some sort of competitive advantage.

A great domain name can give you competitive advantage on marketing side but if your business model is based upon low ASP and thin margins it’s always going to be a grind.

I used to be head marketing for Fanatics who launched NFT site Candy.com so admittedly biased in my opinion.

Where is travel.com at? Much better than any brandable?

“I used to be head marketing for Fanatics”

Forget about a domain choice, we need to talk about what the new deal they have in place with the leagues that takes affect in what 4-5 years will do to people who love the hobby and are already getting squeezed by high prices lol

You cannot offer several times more to leagues for the rights and not raise prices on the consumer. No one cares about one stop shopping cards/grading/storage blah blah blah if it costs a small fortune. Small card shops will be crushed, it is essentially a monopoly. I suspect they will gobble up or team up with Panini or Topps at some point to some degree. Cementing the monopoly but paying off the two biggest threats to a suit.

Also and while I am sure Fanatics is secure since they do other things, buying into a hype machine (the card market) currently is (and dropping by the way, nearly 50% fall off this half of the year in the secondary market at least) is risk..Y to say the least.

Good thing Americans love their sports even in a down turn.

Ok, rant off lol

I use to visit Candy.com when they were selling candy. I thought it was a great idea and website. I always think about Nuts.com too when I think of Candy.com. Their profit margins are probably small as well and they have to do volumes in sales to gain meaningful profits but they are still selling nuts.