CEO tells the Voice.com story.

MicroStrategy (NASDAQ: MSTR) is both domain famous and bitcoin famous.

The company acquired lots of great domain names early on, such as Alert.com, Courage.com, Mike.com and Usher.com.

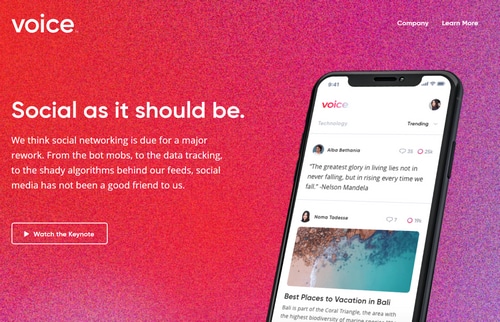

Then, last year, the company sold one of its domains for a record amount: Voice.com for $30 million.

Voice.com sold to a cryptocurrency company. MicroStrategy then went big on bitcoin, buying $425 million of bitcoin.

MicroStrategy CEO Michael Saylor was on The Pomp Podcast this week. He talked about why his firm acquired so many great domains and gave details on selling Voice.com.

It’s a great interview. Saylor explains that the first offer was for only $150,000, and he kept ignoring them. He told them not to bother him until it was at least $10 million.

The embed below starts at the point he begins discussing domains.

Microstrategy did extremely well on it. Even after the buyer raised billions there is still basically no activity on that site.

The name will eventually come back on the market and it will go for under 500k.

Well, I don’t watch many podcasts, but I was curious to hear what Michael had to say about the sale of Voice.com. Impressive sale and he is right, Voice.com is worth more than $30 million dollars, most likely $50 million max for just the domain itself IMO. He has some other really good domains as well.

Michael is a very smart guy, I love his passion and how he learns from his mistakes.

But his companies all cash ( almost 500 million) purchase of Bitcoin in 2020, Insane!

There is a better chance of Bitcoin going to zero in the next 10 years then going to the moon IMO.

Wall street owns Bitcoin’s price now (he should know this), Bitcoin futures. China can mine Bitcoin and pump it all they want, but the street always wins!

He missed the boat on Bitcoin multiple times 2013 and 2017, even retail Investors knew you could make money on Bitcoin in 2017. He got into Bitcoin way too late IMO.

Gold will always be better than Bitcoin IMO. Bitcon is just software, not even hardware, other than the multiple servers it is stored on. Hackable!

As for being store of value, Bitcoin’s original purpose was to be a digital currency.

Speculators made Bitcoin into a store of value.

If a group of people believe in something enough and they sell the idea (Bitcoin or nTLD’s) to others, people will follow and believe in it as well.

well said !

Thanks. Common sense has to come into play at some point!

Bitcoin forking is what killed Bitcoin’s chance at greatness.

Wall Street is just a vampire draining it dry until it’s dead.

What if you are completely wrong?

Not that I am a Bitcoin fan (wouldn’t touch it) but if you predict a whole bunch of things it is likely to be at least 50% wrong.

Time will tell. I like my chances (percentage). 😉

Bitcoin is also more correlated to Gold now more than ever.

Gold is not going to $50k or $100k.

right now bitcoin is 1/30 the market cap of gold. if bitcoin achieves parity in ratio with gold…then bitcoin would go up by 30x per coin.

Pipe dream.

Pipe Dream ?

I am long on digital assets in aggregate ….maybe not bitcoin per se….but the future is in blockchain and digital network value. there will be a multitude of coins in the future including stable coins which represent a multi trillion dollar industry.

Don’t be such an ol’ timer Mr. Thorpe 😉

I am being a realist.

Blockchain and Bitcoin are already outdated.

Stablecoins replaced unstable coins like Bitcoin. Neither of them are stable or 100% guaranteed safe.

There will always be new software to pump like a newer coin or network.

Bitcoin or stablecoins, FinTech or DeFI, Blockchain or Hashgraph, Centralized or Decentralized.

Call them whatever you want, re-name them name too.

In the end they’re all the same thing, software that can be changed and is Hackable.

Mark.

Unfortunately you are very misinformed.

Very misinformed.

And you are spreading fake news.

You are an amateur domainer.

You have a lot to learn.

Your comment reply is not “common sense” but rather pure ignorance — and tunnel vision arrogance.

Invest your time learning about a highly-complex and completely unfamiliar subject — prior to pretending to be a subject matter expert in a public forum.

You are embarrassing yourself.

Gold has not outperformed and will not outperform Bitcoin.

Bitcoin is up 9,000,000% on the decade (2010 – 2019) and was the #1 asset of the decade — in the entire world.

Bitcoin invented decentralized trust and true digital scarcity.

Bitcoin is the original name of the Software (officially) Bitcoin Core. The global participants who peacefully opt-in and run the official software establish the “Bitcoin Network”. The Bitcoin Network is the world’s largest super computer. Its exclusive computer network / communication protocol “mission” is to follow protocol consensus rules and record state to the append-only universal distributed, transparent, and immutable ledger of indisputable “truth”, dubbed “block chain”. Not “blockchain technology”. This is mostly corporate “innovation” hype (lies) and unending (global) scams. This system (is the only true and secure block chain) provides and enables for the first time in human history a decentralized monetary system which boasts a native and provably-scarce digital asset, (utxo’s) dubbed “BTC” which never leave the “block chain”. Bitcoin Wallets (true FOSS non-custodial) query the block chain in real-time to display balances, and enable users to send, receive, trade, and control their own assets. Bitcoin Exchanges use “accounts” and traditional server-client model and effectively give you an IUO for your assets, although some provide insurance, vaults, etc.,. However, if you run the Bitcoin Core Software (full node) and Client (built-in Wallet functionally) — it enables you to transact and self-custody your assets without ANY third-party intermediary whatsoever — completely P2P across the network — and enables users to embrace financial self-sovereignty, within a decentralized architecture and sound-money system. This system showcases a 140-year supply curve and maximum supply, (fixed supply: 21 Million) of new money (BTC) distribution, distributed directly as the block reward as a honesty incentive to miners, worldwide for protecting the Bitcoin Network (and its holy grail ledger of truth) with their software, hardware, time, physical energy, actual energy expense, security, etc., as a security-incentives blueprint, social scaling and network effects. Each individual (1) BTC unit is divisible by 100,000,000 Sats, (Satoshi’s). This is effectively the world’s first a global standard of (digital) value and the world’s first global standard of financial settlement within a non-political, immutable, and global 24x7x365 liquid market place which is floating above $200 Billion USD today, and will be absorbing trillions of dollars of debt-based fake fiat currencies all-around-the-world over the coming years.

You basically,…know absolutely nothing.

“Bitcoin is high-powered money.” – Hal Finney

Bitcoin is the future.

You’ve been incredibly incorrect — for eleven consecutive years.

“Pretending to understand is shameful.” – Jack Ma

Go learn.

Stop talking.

I will not be checking this thread ever again. There is no need to reply.

Responding is wasting even more of your time.

Go learn.

Stop pretending.

Have fun pumping.

Mark I really hate to break it to ya bud but you sound pretty silly in this thread (and in others) with your negative famous rants about BTC. Oddly without any documented skills, experience or actual facts. It’s weird but it shows your lack of intelligence either way.

How do you not realize in late 2020 how completely incorrect you are in your statements, current and historical? Why do you continue this odd behavior of pretending to everyone you are an educated computer science major with deep knowledge of protocol development, macro economics, and monetary history?

Do you not realize this is actually a very well documented global computer science (BGP) dilemma that the Bitcoin inventor(s) finally solved after 40/50 years?

Do you know anything about the history of hard money and the transition to enslavement fiat currencies?

How are you not aware that the largest legacy financial institutions, stock exchanges, visionary inventors, and multi-billion venture capital firms in the country and around the world are integrating BTC and Crypto?

Have you not ever heard of NYSE, NASDAQ, Fidelity, JP Morgan, IBM, A16Z, DCG, Pantera, USV, PTJ. There are thousands more and many more coming.

Unfortunately your aggressive and consistent tone probably convinces some to drop their curiosity instead of doing their own homework. It’s clear you have not done yours.

Cheers Mate.

Pumping ? he is having the foresight to believe in the future. you just can’t let go of the past. you also made zero money in crypto, and im willing to make a bet you dod not become a millionaire with domain names….and missed that boat as well (early initial acquisitions).

You are an old timer with limited to no foresight.

It is a shocking bet for a company to make. Treasury (handling excess cash) is usually a boring thing. The goal is to maintain the value, not necessarily make a lot of money.

You can make a good argument that, if the company doesn’t need all of this excess cash, it should return it to shareholders and let them decide what to do with it. They can invest it in bitcoin on their own if they’d like.

Well said, Andrew.

cringe.

that’s a very conservative view.

on the other hand you can leave the cash in a zero interest account or you can invest it in bitcoin instead of earning ZERO…a well placed bet on the future with great growth potential.

so….why return it to investors when he can use that cash for growth and acquisition later on ?

amazing to read how stupid Domainers are when it comes to BTC. Michael Saylor is not late, he’s early. BTC is going to $100k by 2022, and $1m by 2027.

What were you predicting in 2017?

Biggest percentage gains have already been made on Bitcoin. Back when it was less than $1.

I found Bitcoin at $20, even then it was too late.

Mark,

Respectfully, you don’t see what’s coming and are only reciting the obvious topics de jour in blockchain/crypto.

I would like to have side action with you that says tokenization, coins, crypto, defi, digital assets and related assets/tech will be a multi trillion dollar industry and the wave of the future.

You sound like an old timer hanging onto the past, and someone that likely feels scorned for missing the first giant wave of growth. To claim that it is over in any capacity us so misguided that it’s scary.

I’ve been investing in digital assets since 2000.

The only assets that grow and survive are one’s that are embraced by the average person.

Good luck.

Give it time my friend. give it time.

the internet itself was initially only well suited for nerds.

this industry will evolve to the masses. You are just unable to see that future….

digital value is actually the ONLY way to unlock the worlds untapped value in terms of human resources and contribution.

If you were investing in digital assets since 2000 you were way too early for bitcoin and crypto….and therefore you must mean websites, domain names, e-commerce and internet related tech….and look how that turned out.

trust the process and don’t resist it old timer 😉

Good luck.

i think the Bitcoin tack on the comments, takes away from the the fact …..

that this was really ………….. GOOD STUFF Andrew, great get and informative

and entertaining. DNW is really rocking. appreciated.

Page

Wasn’t my intention for Bitcoin to take over the comments.

You are such a kiss arse. The bitcoin talk is on point and is correlated to the value of the domain in question.

and yes, no one is refuting that the website is solid content. To state that is actually off topic and obvious.

I’m no kiss ass, I can promise you that Lol.

I know who Page is and he knows who I am as well. I respect his input, unlike others.

I was saying Page is a kiss ass, not you.

but this last comment us also very “eye roll” (cringe).

Duly noted.

Bye now.

cringe alert.

The truth:

1. Government can kill Bitcoin any time it wants. All the hype about how it can’t because of decentralization or any other reason is nonsense.

2. Bitcoin’s perceived value is based entirely on its utility and acceptability as a form of payment, as “money.” But government will never allow anything to be formally regarded as money which is beyond its control. The US government specifically will kill and destroy or seek to kill and destroy or at least effectively suppress anything, everything, and everyone perceived to threaten the US dollar. Even now the US government will not allow Bitcoin to be considered money or currency, its original purpose, but will only allow it to be regarded as a “commodity.” Exactly what it’s done with regard to gold. The mental compromise of Bitcoin proponents in the face of US government power in terms of embracing “store of value” and concepts like that is more nonsense. There is no value stored if Bitcoin is not ultimately usable as money.

3. All Government would ever have to do to effectively kill Bitcoin is simply issue a single word. Then about as close to 100% of businesses nationwide and worldwide would fall in line. Bitcoin would be practically dead, unless you cling to the infinitesimal remaining stragglers and rebels mostly still willing to take Bitcoin for the criminal purposes it used to be famous for as being “not dead.”

4. Obviously, however, digital and blockchain (or whatever you want to call it), is here to stay.

5. Only for the time being, Government is allowing Bitcoin and other cryptocurrency to exist, even function as money as long as it doesn’t do so in a way perceived as problematic, and to some degree flourish. That is because “Wall Street” and commercial special interests want that and want to make money with it. The US government, for example, is run and controlled by the same corporate/commercial special interests on both sides of the fake left/right duopoly.

6. We already have a digital currency: it’s called the US dollar.

7. The world is clearly heading in the direction of greater and greater digital implementation and control of “money” and “currency.” This trajectory includes and is for the purpose of greater and greater control of people, and less and less human freedom.

8. At some point in the future, it is reasonable to infer that government control of digital money will be practically complete. At the moment, this is also the most reasonable and compelling inference to be derived from the famous biblical prophecy of Revelation 13:16-18. As an interesting coincidence in fact, the technology has already existed for quite some time now for such a fulfillment of that biblical prophecy to consist of a literal “mark” on the human body, and not, as so many tend to speculate and suggest, requiring anything like a “chip” or sub-dermal implant of some kind.

For reference:

https://www.biblegateway.com/passage/?search=Revelation%2013:16-18&version=NASB

Can powerful Quantum Computers Destroy Bitcoin itself? https://dailyhodl.com/2020/08/23/will-quantum-computers-really-destroy-bitcoin-a-look-at-the-future-of-crypto-according-to-quantum-physicist-anastasia-marchenkova/

Microstrategy buys more bitcoin

https://www.bloomberg.com/news/articles/2020-12-05/microstrategy-buys-more-bitcoin-at-average-price-above-19-400

Mark’s ignorance didn’t age too well 2-3 months later. LOL

Its easy to get the sheep crowd to agree with you even when you are spewing baseless opinion with no knowledge of the subject, huh?

Wait until Mark finds out the US dollar has not been backed by gold for a very long time now…