The company that sold Uber.com to the transportation company could have earned $532 million.

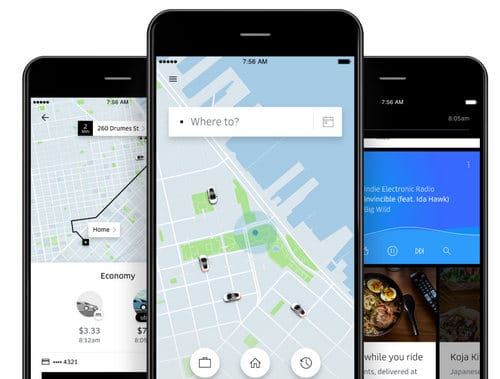

Raid hailing and mobility company Uber went public today. It hasn’t fared so well in its debut but still got a big valuation.

Early investors in the company got a great return on their investment. The Wall Street Journal calculated the returns for early investors such as First Round Capital, Lowercase Ventures and Shawn Fanning.

One company that could have hit pay dirt is Universal Music. Its investment arm previously backed a company that used Uber.com. It went defunct.

It sold the Uber.com domain name to Uber (which was called UberCab) for the equivalent of $107,148 in equity. The Wall Street Journal calculates that would be worth $532 million at the IPO.

But Universal Music cashed out in the company’s A Round for $863,000.

Oops.

Universal Music isn’t the only one to miss out on riches in a domain deal. The guy who sold the DropBox.com domain took $300,000 in cash. If he took the equity option it would have been worth hundreds of millions.

Of course, there are plenty of examples of people taking equity in a deal only to lose it all.

An ideal scenario would be to get cash + equity, where the equity is basically icing on the cake or a bonus on top of the cash. That way you still get cash in your pocket but you also get equity that you have no pressure to sell and that can one day possibly turn into millions of dollars. Getting all equity is often just too risky, imho.

The equity is always going to be instead of some amount of cash, no company is going to give it away as “a bonus” and tax would need to be paid on it aswell. If the equity was worth say $100k there is always going to be pressure to sell.

Exactly

Great story. Very interesting.

what is an uber?

I read about one guy who was working in the Apple Store who took a job in marketing while Uber was in its nascent startup stage. All his co-workers thought he was nuts. He’s already sold 1/5 of his stock and has retired at the age of 29. With the proceeds from 1//5 of his shares, he’s bought 5 properties in Austin, worth over 3 million USD, 2 homes in San Francisco. He’s living in Austin now, with his GF, for tax reasons. The early workers hit the power lotto, I remember the story about the graffiti artist who was living out of his van in the Bay Area. He took stock in FB rather than 20 K in cash for painting the wall mural. This resulted in 80 million USD — for 5 days of work.

I am seeking equity in my company, not just the domain per se, Any interest, let me know. myyaags @gmail

You don’t have equity in your own company and you’re spamming here to find it?

How much would uberroadsidehelp.com worth? You think? Registered trademark.

Someone wants Ubus.com. !!

What’s the domain name about

This is really interesting

Oh my… But dont you think the company would go for another name aside that ?

And uber.com would have lost it worth ?

Really

Interesting Story.

Uberspace.com

Worth?

Exactly

I dont think it really matters

nice one out here

hmmm interesting… why though?

That’s a lot of money

Wow lovely

Nna ehn, lekwanuy money

Make dem just cut small give me

Nice article

Jesus this is a miracle imagine buying one domain today making millions out of it tomorrow this is real an amazing business

Uber should come an buy my own domain name if at all they are looking for domains to buy

Imagine getting that domain right now. You’d be raking millions in no time.

Like the post said, had it been the company knew but too bad you can’t determine a companys success from the startup.

Had it been the company can try seezing or something just to make uber pay them an income.

Crazy people. This outrageous but interesting

wow, that’s great

Taking equity on any deal is just a 50/50 deal.