Is .com’s growing base of registrations about to go negative?

Jim Bidzos was wrong.

Bidzos, the CEO of .com registry Verisign, was celebrating a better-than-expected third quarter last year. Domain name registrations were higher than normal thanks to emerging markets.

Bidzos and his leadership team thought the short-term boost was over. On an investor conference call, Bidzos said:

During the third quarter, we saw strength in gross additions coming out of emerging and international markets, particularly in Asia. While we believe these markets will continue to perform well, we believe the pace of activity we saw during the third quarter will slow sequentially in the fourth quarter. Also due to seasonal factors, the fourth quarter tends to have fewer net additions than the third quarter, as was seen in the last two years.

He predicted the company would add 1.1 million to 1.6 million .com and .net domain names to the base in Q4 2015 after deletions.

It ended up adding 4.6 million.

Like I said, Bidzos was wrong. Just in a good way.

The fourth quarter last year saw stunning growth in new domain name registrations as domain investors expanded their definition of what makes a domain name valuable. Four or five random letters or digits? Try six. Those are gone? Then seven, eight and nine.

All told, 10.6 million new .com domain names were registered in Q4 2015, up from 7.3 million in the same quarter the year before.

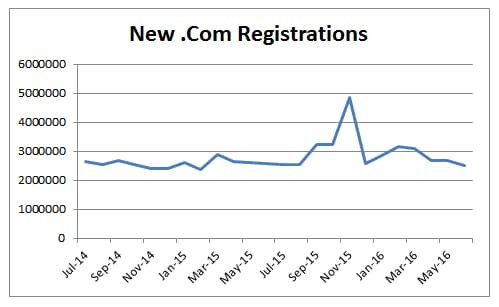

November 2015 was the high water month with 4.8 million registrations.

eName, a Chinese domain name registrar that generated about 15,000 .com registrations in October, suddenly pulled in 1.06 million. In a single month.

HiChina, another Chinese registrar, jumped from about 100,000 to 650,000. And HangZhou AiMing Network Co. registered nearly a half million domain names after registering just 10,000 the month before.

You’d think this would be good news. But for a monopoly like Verisign, shareholders cherish consistency and predictability. And the current quarter–one year after the blockbuster one–offers neither.

.Com’s steady growth could be heading for a cliff this quarter thanks to the better-than-expected quarter a year ago. Almost all of those 10.6 million domain names registered a year ago are coming up for renewal and it’s hard to predict how many of them will be renewed.

About 50% of new .com registrations are renewed on their first anniversary. But renewal rates tend to be lower in emerging markets. And in China, where domain investor frenzy created a bubble? It’s hard to know.

It might be a binary question. Either 90% or 10% will be renewed. Or it could be in the middle, with people keeping their “best” six character domains and dumping the rest.

Given how the Chinese market has fared this year, I think a lot of people will choose to not throw good money after bad.

Financially speaking, the Q4 2015 boom was good for Verisign any way you look at it. Even if a domain isn’t renewed, the company still got an extra eight bucks for renting it over the past year.

But investors that like predictability aren’t Verisign’s only problem. I imagine the same new top level domain name companies who keep beating the drum about .com hitting a peak have already crafted press releases to mark this occasion.

There’s a great chance that the total base of .com domain names will fall in Q4 compared to Q3 of this year. When that happens, some people will push the narrative that new TLDs have caused .com to peak.

In reality, it was China. It created a bubble in .com and that bubble is deflating.

But that might not be the story that makes headlines. And that would be bad for .com.

Think investors counted this in. Verisign has been stated warnings about these renewals in their earnings calls. Plus the stock is like 14% below it’s high.

At a low enough renewal price they will have 90% renewal. If i were verisign i’d lower new reg price too (i’d limit to asia) to pad the zone in Q4, and not just on .com but .net too

I saw a 2.99 flash sale on .net at moniker this month.

$2 .net flash sale over at Gandi

That might be moving the Asian market registrations into a boom and bust cycle. It might lessen the impact of the deletions but it would be offsetting the drops to the next year. Even with the .eu ccTLD, the landrush spike and its drop echoes are visible ten years later. With .COM, some of the discounting has created boom and bust cycles on particular registrars that avail of these promotions. Such a renewal offer might have to be prioritised on a registrar by registrar basis. But could this bubble be reinflated?

The renewal rate is traditionally low for some hosters/registrars in the China/Hong Kong/Japan markets. Most of the Chip bubble drops will be concentrated on these hosters/registrars. It will affect some of the Western registrars but most of these have >50% renewal rates. The problem is that this bubble is not just confined to .COM TLD. It has also affected .NET, .ORG, .BIZ, .INFO and .MOBI. The fallout is going to be spread out over at least the next seven months. It might be possible to estimate the extent of the non-renewals. The .COM market is not a single market. It is a set of market with a small global market and a lot of country level markets. The Rest of the World registrars may be largely unaffected by these non-renewals. The spike in Chip registrations dragged the web usage percentages on new .COM/NET registrations when these promotions were active. Many of these Chip registrations had no working websites.

Some of the new gTLDs also have serious Chip bubble exposures. The renewal rates for some of them are better than those for .COM but the affected new gTLDs have developed their own mini-bubbles based on discounting and freebies. In terms of web usage, most are not yet at the same level as web usage in .COM or the ccTLDs but a few of them, like .REALTOR and .KRED are actually doing better than .COM and most ccTLDs. The .KRED gTLD is actually more a directory than a gTLD though and .REALTOR is a niche TLD. The high registration fee on some of the new gTLDs has also resulted in better than expected renewal rates with a few of them seeing ccTLD level renewal rates. That high registration fee may insulate some of the new gTLDs from the bursting Chip bubble but some of the new gTLDs, which went CN/HK/JP dominant are about to experience a spike in deletions.

The *average* usage rate for Donuts ~200 TLDs is ~30%, which is less than .com (~40% by same measure – which is on all names in the zone, not just newly registered names). Some of ours have better usage than .com. And we do not have much “chip-bubble” exposure. I agree some other new gTLDs (and .com and .net) do have that exposure.

It is the renewal rates on the low-price new gTLDs that are problematic. The higher priced new gTLDs do not have a significant chip-bubble exposure. There’s a point in the evolution of some of the exposed new gTLDs were the registrant base of these affected new gTLDs flips from being Rest of World dominant to being CN/HK/JP dominant. Western hosters/registrars tend to have a >50% renewal rate for non-discounted registrations in .com. (Depending on the country, the renewal rates can be upwards of 70%.) Some CN/HK/JP hosters/registrars can have similar rates for non-discounted registrations but there are a few volume orientated hosters/registrars that are using discounting/promotions as the mainstay of their business model. Some of these have between 2% and 30% renewal and a some of the new gTLDs where discounting is in heavy use are already displaying the classic boom and bust cycle. These gTLDs have also attracted cookie-cutter affiliate content (adult/gambling/questionable goods etc) sites that are dependent on free or heavily discounted registrations. Having too many of this kind of hoster/registrar near the top of a gTLD is not a good thing for stability as the new registration and drop spikes will be more extreme.

These registrars have basically created a business model that is dependent on discounted new registrations keeping ahead of deletions. While any discounting promotion will have a low percentage of renewals (around the 5% mark depending on registrar and gTLD), the focus of these discounters is on getting one-off new registrations rather than registrations that will renew. It might be an interesting exercise to break down web usage by hoster in some of these gTLDs. I have a rough equation for renewal predictions that ties the hosters/registrars in with web usage data (and a few other elements) and some of the early tests tended to highlight problem gTLDs where discounting was being used to grow the zonefile. Lower priced registrations generally don’t encourage the registrant to develop sites. Higher priced registrations tend to exceed a kind of financial pain threshold that makes registrants wary of dropping them.

Let’s compare with the absolute and relative growth in other TLDs.

It is all that 5/6L .com’s, and the 6,7,8,9,10 N.com’s that were registered in Q4 last year, along with some .nets this stuff is going to drop, with very little dropcatch follow thru.

You’re right, Andrew.

Whatever the renewal rate on last year’s speculative Chinese purchases, the unsustainable rate of growth we saw at that time could never have continued. So even if the .COM base doesn’t shrink due to deletions, registration numbers may plateau during a market correction. At a minimum, growth would slow.

nTLD registries would be smart (if disingenuous) to point to this as a sign that the .COM name space itself is saturated. And, as you say, some probably will.

Millions of previously registered domains becoming freshly available can hardly be evidence that nothing’s available. Nor do 8-digit numerical strings say much about keyword-based names. But facts play less and less of a role in society nowadays. Anyhow, if registry misinformation raises the demand for my own nTLD inventory, I suppose I’ll just have to live with that.

PS and our usage rate is growing, while .com is relatively flat.

PPS a few examples of Donuts TLDs with higher-than-com usage rates are .photography, .city, and .church

i own a few of the new gtld’s and would love to think they might skyrocket but the truth is that dot com is the foundation that the domain name industry is built on, in reality there is dot com and then there is everything else

Well said Christy I think the new gtlds were all DOA and a waste of time and money. Sure, the number of .COM extensions may go up and down from quarter to quarter and year to year, but at least it is not a concern that the entire tld will go under.

I agree with this concept, but branding is all about familiarity. mega.pink is not as good as megapink.com, but it is definitely worlds better than megapinkstuff.com or megapinkyou.com.

Branding is NOT all in a name. That’s what domain names prove, HOWEVER, if you can get that brand off the ground, you may be better served by a TLD than a com

Kind of a chicken and egg question.