But price hikes help the company post solid financials. Verisign (NASDAQ: VRSN) reported earnings yesterday and, once again, blamed China for a drop in domain name registrations. The company had 9.0 million new .com and .net registrations during ... Continue ReadingLeave a Comment

Verisign announces .com price hike to $10.26

· Policy & Law.Com domains will cost $10.26 plus markup beginning in September. Verisign (NASDAQ: VRSN) today announced that it is raising the wholesale price of .com domain names on September 1, 2024. The registry currently charges registrars $9.59 per year ... Continue Reading4 Comments

China sinks Verisign’s Q3

· Services.Com would be growing if it weren't for China. Verisign (NASDAQ: VRSN) reported third-quarter earnings after the market closed yesterday. The combined base of .com and .net domain names continues to shrink, which the company blames on lackluster ... Continue Reading5 Comments

Verisign: China weighs on .com, .net prices going up

· ServicesSoft demand in China hurts Verisign's quarter. Verisign (NASDAQ: VRSN) reported Q2 earnings after the closing bell yesterday. Revenue grew 5.7% year over year and operating income grew 5.5%. The overall base of .com and .net domain names ... Continue ReadingLeave a Comment

Verisign gets patent for cryptocurrency-backed sale and transfer of domain names

· Policy & LawPatent describes way to use blockchain technology for the sale and transfer of domain names. The U.S. Patent and Trademark Office has granted patent number 11,645,370 (pdf) to Verisign (NASDAQ: VRSN) for "Transferring a domain name on a secondary ... Continue Reading1 Comment

ICANN Board: no foul play in .web auction

· Policy & LawICANN Board gives approval to contract the .web top level domain. The ICANN Board of Directors has determined that an agreement between Nu Dot Co and Verisign for the .web top level domain name did not violate the new TLD application terms. The ... Continue Reading3 Comments

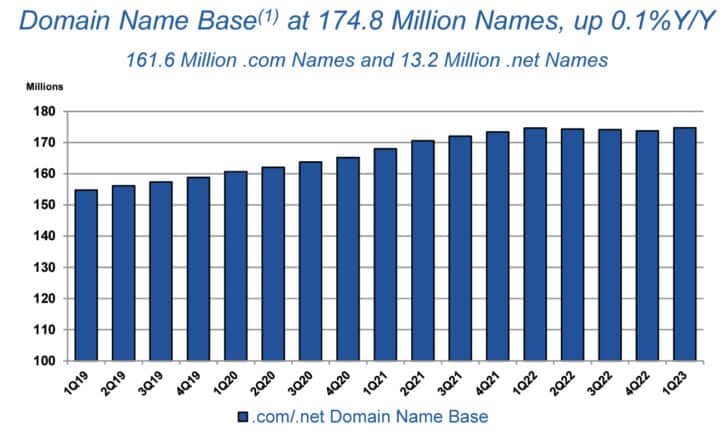

Verisign adds 1 million .com/.net domains in Q1

· ServicesDomain registry ups the lower end of its revenue guidance for the year. Verisign (NASDAQ: VRSN) reported first quarter earnings this afternoon. The company ended the quarter with 174.8 million domains in the .com/.net base, which was 1.0 million ... Continue Reading1 Comment

Verisign gets patents covering blockchain and registration via chatbot

· Policy & LawDomain registry expands on previous patents with three new patents granted today. The U.S. Patent and Trademark Office granted three patents to Verisign (NASDAQ: VRSN() today. Patent number 11,621,939 (pdf) is for Domain name suggestion and ... Continue ReadingLeave a Comment

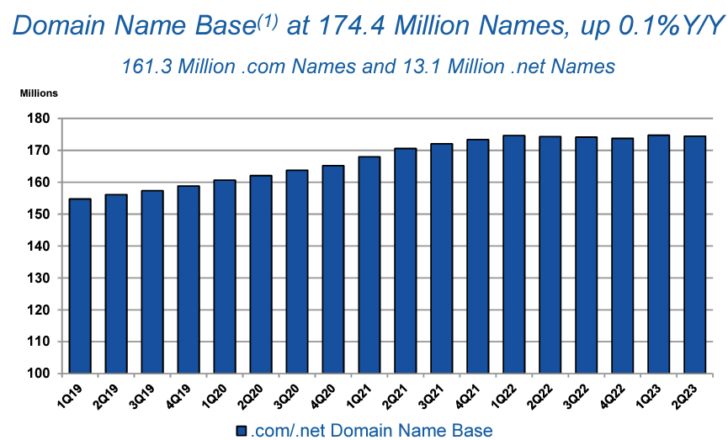

Verisign earnings: domain growth even less than expected

· ServicesCompany missed its lowered guidance. Verisign (NASDAQ: VRSN) released its Q4 and full-year 2022 earnings results yesterday after the market closed. The company is generally good at pulling the right levers to hit its guidance for the .com/.net ... Continue Reading4 Comments

Verisign announces another .com price hike

· Policy & LawCompany will raise wholesale cost of .com domains by 62 cents. Verisign (NASDAQ: VRSN) today announced a 7% increase in .com prices to take effect on September 1, 2023. The wholesale price for .com domains will increase from $8.97 currently to ... Continue Reading12 Comments