Ranking the biggest registrars by domains under management. Each month, I publish a report of the top 10 domain name registrars in .com domain names. This report is based on data that registries submit to ICANN every month. ICANN publishes data ... Continue Reading1 Comment

2023 top stories: GoDaddy’s “commission alignment”

· ServicesGoDaddy's Dan.com acquisition continues to reverberate in the domain aftermarket. You might think it's odd to say that one company changing its sales commissions is a top story of the year. But GoDaddy is the dominant player in the domain ... Continue Reading1 Comment

My thoughts on the GoDaddy NameFind auction

· Domain SalesI liked GoDaddy's auction, but I also have some suggestions for improving it. GoDaddy (NYSE: GDDY) ran auctions of some of its NameFind inventory on GoDaddy Auctions for the past couple of weeks. I think it was wise for GoDaddy to run this ... Continue Reading6 Comments

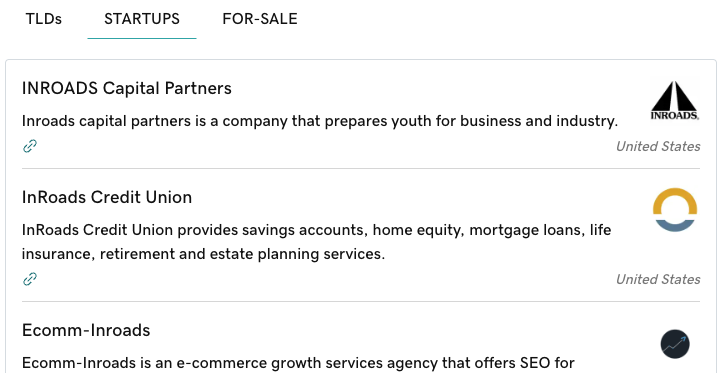

Using Domain Academy’s Research Snapshot to evaluate domains

· ServicesThere are some neat metrics in this tool included with Domain Academy. I've been bidding on many of the domains in GoDaddy's NameFind auctions. One of the tools I've used to evaluate my bid prices is Domain Academy's Research Snapshot. The tool ... Continue ReadingLeave a Comment

2023’s top stories – DNW Podcast #465

· PodcastsReviewing the year in the domain name business. 2023 has been full of activity in the domain name business. There have been acquisitions, changes in hot technologies, and much, much more. On today’s show, I discuss what I think were the five ... Continue ReadingLeave a Comment

November’s top stories on Domain Name Wire

· UncategorizedTop clicks for November: Trump, Adsense, GoDaddy and more. These were the top stories on Domain Name Wire last month, ranked by views: 1. Donald Trump loses cybersquatting fight against Mar-A-Lago domain - A pet duck foils Donald Trump's quest ... Continue ReadingLeave a Comment

GoDaddy auctions NameFind domains, adds .io and .xyz to Fast Transfer

· ServicesPossible bargains at GoDaddy, and look forward to more .io and .xyz sales thanks to Fast Transfer. GoDaddy (NYSE: GDDY) and Afternic are starting two initiatives this week that domain investors should pay attention to. First, starting today, the ... Continue ReadingLeave a Comment

.Com domain registrars, ranked

· Domain RegistrarsHere's how domain registrars fared with .com in the most recent public data. ICANN has published the latest official data from Verisign (NASDAQ: VRSN) about the .com namespace. This registrar-by-registrar report covers August 2023. Note that the ... Continue Reading1 Comment

Afternic search and Domain Academy – DNW Podcast #461

· PodcastsJoe Styler discusses a new search tool and what's ahead for Domain Academy. Want to find bargains at Afternic? Filtering through Afternic’s 23 million domains just got a lot easier thanks to a new tool in Domain Academy: Afternic Advanced ... Continue ReadingLeave a Comment

GoDaddy reports Q3 earnings

· Domain RegistrarsRevenue up slightly from a year ago, but segment that includes domains drops slightly. GoDaddy (NYSE: GDDY) reported earnings after the market closed today. The company grossed $1.07 billion in the quarter, up 3.5% compared to the same quarter a ... Continue ReadingLeave a Comment