How Michael Blend finally struck gold with domain names. The domain name opportunity was staring Michael Blend in the face on two occasions, but he missed it. The third time around he finally pounced on the opportunity...and it paid off. Blend ... Continue Reading3 Comments

Demand Media spin-off of Rightside set for August 1

· ServicesRightside's debut as its own publicly-traded company is imminent. Demand Media plans to complete the spin-off of its domain name business on August 1. Rightside will become its own public company on that date. It will trade on the NASDAQ under the ... Continue ReadingLeave a Comment

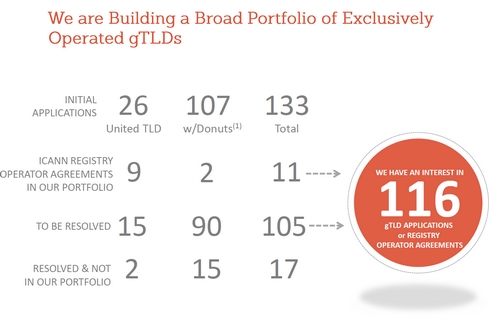

Demand Media’s Rightside reveals numbers and bet on new TLDs in SEC filing

· Domain RegistrarsRightside's growth is highly dependent on the success of new top level domain names. Demand Media is spinning off its domain name business as a new publicly traded company, Rightside. Today the company filed documents with the U.S. Securities and ... Continue Reading1 Comment

Donuts assigns rights to .futbol and .reviews top level domains to Demand Media’s Rightside

· ServicesRightside has two more top level domain names in its new TLD portfolio. Demand Media filed documents with the SEC today related to its spinoff of Rightside, and also published an investor presentation. The disclosures show that Donuts has assigned ... Continue Reading2 Comments

Republican National Committee loses fight over .republican

· Policy & LawRNC loses objection against Demand Media's application to run .republican top level domain name. The Republican National Committee (RNC) has lost a community objection it filed against Demand Media's application to run the .republican top level domain ... Continue Reading3 Comments

2013 Top Stories: Demand Media to spin off domain business

· ServicesRightside will make some noise in 2014. Demand Media has had its share of ups and downs since it was founded in 2006. 2013 was mostly a year of downs for its content business, which includes eHow and Livestrong.com, thanks to Google's search engine ... Continue Reading2 Comments

Domain parking clawback dings Demand Media earnings, plus first look at Rightside numbers

· Domain ParkingCompany hit with parking clawback from a previous quarter. Ask any domain parking company about their top frustrations, and clawbacks will be high on the list. Basically, their upstream ad partner will clawback previously paid revenue based on traffic ... Continue ReadingLeave a Comment

I was right: Demand Media spinoff to be called RightSide

· Domain RegistrarsRightside is right. Last week I wrote about how signs were pointing to Demand Media calling its domain name spinoff Rightside. Today the company formally announced that the name will indeed by Rightside. Rightside Group, Ltd. will encompass ... Continue Reading1 Comment

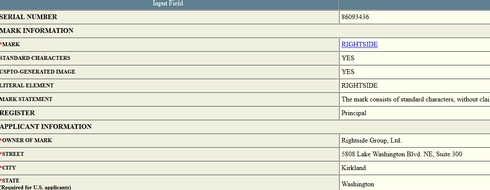

Demand Media to call spinoff Rightside?

· Domain RegistrarsCompany files trademark applications that may be for spinoff. Demand Media is in the process of spinning off its domain name business into a new publicly traded company. Will it be called Rightside? Earlier this month Rightside Group, Ltd. filed ... Continue Reading1 Comment

Demand Media CEO Richard Rosenblatt resigns

· Domain RegistrarsRichard Rosenblatt resigns as Chairman & CEO of Demand Media. There's been a change at the top of one of the domain name industry's biggest companies. Demand Media announced today that Richard Rosenblatt has stepped down as Chairman and CEO of the ... Continue Reading2 Comments