Sedo reveals interesting domain aftermarket data. Sedo and InterNetX have released their annual Global Domain Report. The report contains interesting data about both the primary and secondary domain name markets and includes quotes from many ... Continue Reading1 Comment

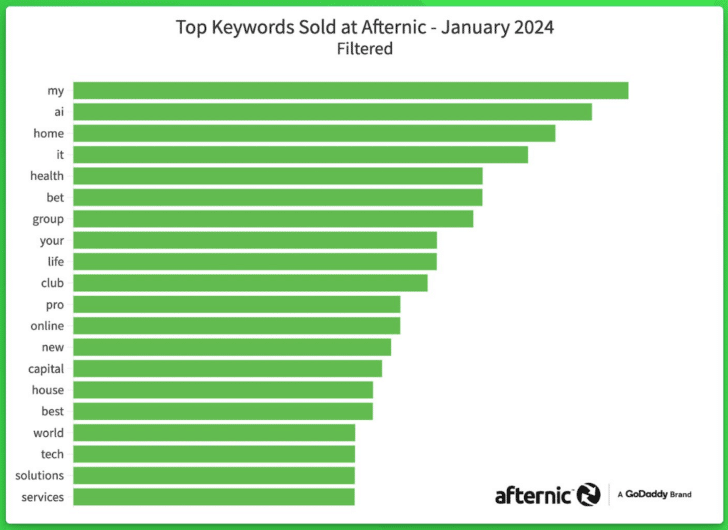

Afternic reveals January’s top-selling keywords in the domain aftermarket

· Domain SalesMy, AI and Home top the charts. Afternic has published the top keywords sold on its aftermarket for January. The words on this month's list are much more expected than some of the oddballs on the previous list. Florida? Sky? Blue? Those were ... Continue ReadingLeave a Comment

End user domain sales including a .mobi (yes, .mobi)

· Domain SalesA .mobi domain has been sold on the aftermarket. You read that right. Hell has frozen over: A .mobi domain has sold on the aftermarket. In the early days of .mobi, a domain extension meant for mobile websites, it made a lot of sense. Companies ... Continue Reading3 Comments

A dozen end user domain sales including .link and .me

· Domain SalesA legal SEO company, a link-in-bio service and others bought domain names this week. Of all of Sedo's sales this past week, the one I'm most curious about is church.sucks. .Sucks domains rarely make aftermarket lists, and this one is super unusual. ... Continue ReadingLeave a Comment

Jewelry company upgrades to GLD.com for $1 million

· Domain SalesA jeweler with major licensing deals upgrades its brand with a great domain name. A successful jewelry upstart has secured a significant domain name upgrade. The GLD Shop has rebranded at GLD after acquiring the domain name gld.com from domain ... Continue Reading5 Comments

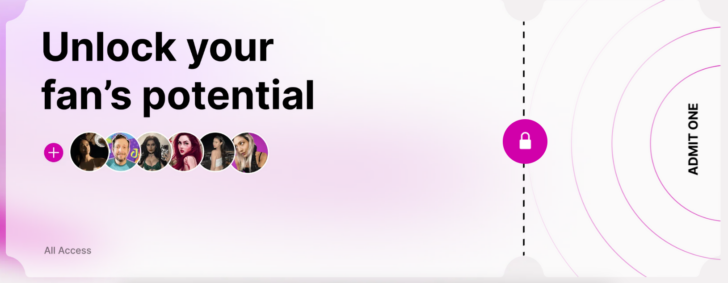

Passes.com: from $70k domain to $40 million venture round

· Domain SalesRichard Lau sold domain name to company that just raised $40 million. A creator monetization platform has raised a $40 million series A round using a great domain: passes.com. Domain name investor Richard Lau told Domain Name Wire that he sold ... Continue ReadingLeave a Comment

14 end user domain name sales led by a .xyz domain

· Domain SalesA metals company, a solar roof business and a financial regulator bought domain names. Sedo's top publicly reported sale this week was hub.xyz. The buyer doesn't appear to be connected to crypto. Here's a list of end user domain name sales that ... Continue ReadingLeave a Comment

Luxe Du Jour buys 3-letter domain for less than full brand name price

· Domain SalesThis company is happy with its three-letter domain, which cost less than it offered to pay for its longer full brand name in .com. Here's an interesting end user domain name purchase story. Luxury goods seller Luxe Du Jour started in Canada with ... Continue Reading1 Comment

Video tutorial: How to using GoDaddy List for Sale instead of Afternic

· Domain SalesSee how to add your domains to Afternic through the GoDaddy interface. I list nearly all of my domain names on Afternic, but I don't log into Afternic to list many of them. Instead, I use GoDaddy's List for Sale feature that lets you list domains ... Continue Reading7 Comments

11 end user sales up to €33,000

· Domain SalesA drone shop, an event production company, and a business broker bought domain names. Sedo's top sale this past week was all .in for $50,000. This domain might have sold for more if .in's registry manager was less erratic. It's not yet clear who ... Continue Reading1 Comment